General News

10 April, 2023

Concerning new scam impersonating banks

Online scammers are becoming increasingly sophisticated in the tactics used to trick victims into revealing financial details and losing significant amounts of money, prompting the Australian Competition and Consumer Commission (ACCC) to issue...

Online scammers are becoming increasingly sophisticated in the tactics used to trick victims into revealing financial details and losing significant amounts of money, prompting the Australian Competition and Consumer Commission (ACCC) to issue a fresh warning to the public.

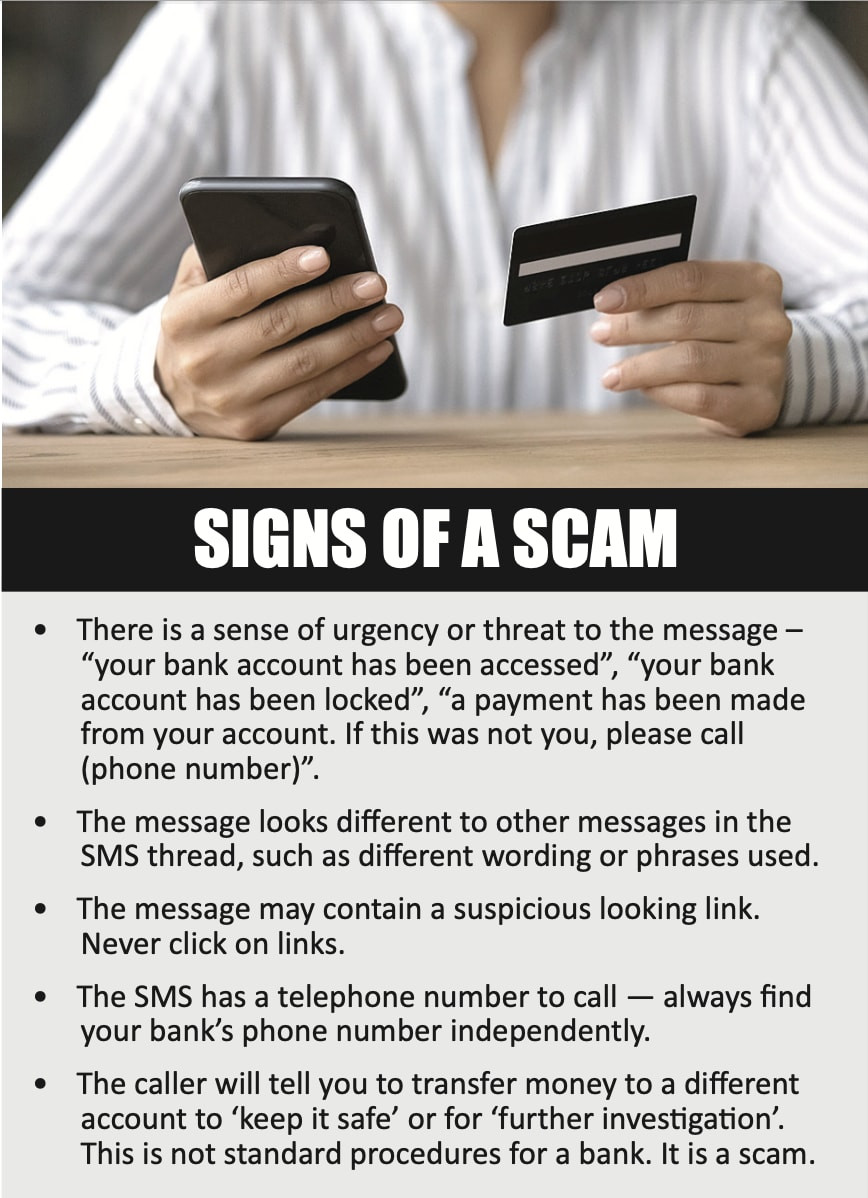

Residents are being warned to be wary of phone calls and texts that appear to be from their bank following reports of what the ACCC has described as an “alarming” new scam known as spoofing.

Scammers use new technology to make calls appear to come from the bank’s legitimate phone number, or by sending a text that appears in the same conversation thread as genuine bank messages.

“We are incredibly concerned about bank impersonation scams because they can be so convincing, they are very hard to detect,” ACCC deputy chair Catriona Lowe said.

“What’s equally worrying about this particular scam, is that it is emptying every last cent out of victims’ savings accounts, with losses averaging $22,000 and more than 90 reports of losses between $40,000 and $800,000. This causes both financial and emotional devastation.

“We know of a man who lost $38,000 after receiving a scam text message about a suspicious transaction.

“The scam text appeared in the same conversation thread as legitimate messages from his bank.

“He called the number in the text and was put through to a member of the bank’s fraud team. Unfortunately, it was an elaborate scam and he lost everything.”

Scamwatch received 14,603 reports about bank impersonation scams in 2022, resulting in more than $20 million in losses.

Total losses to phone and text scams increased significantly last year, with over $169 million lost.

Recent data breaches with high-profile companies have led to increased vigilance of online fraud, which has conversely made consumers more susceptible to scammers, Ms Lowe said.

“Following recent mass data breaches, many Australians were encouraged to monitor their accounts for suspicious activity,” she said.

“Sadly, this has led to consumers acting on these scam calls and text messages out of fear that their accounts have been compromised.”

One local resident, who asked not to be named, told The Advertiser he very nearly fell victim to scammers who recently targeted him via email from what seemed to be his internet provider.

“We were waiting on some documents that hadn’t arrived, when we got an email that looked to be from our provider saying there was a problem with our account,” he said.

“Everything looked legit and I was very nearly about to send the information they requested when I remembered a news report I had read about online fraud.

“I called the internet providor and they confirmed it was a scam, they said they would never ask for banking details via email. And it turned out the person sending the documents we were waiting for had been typing the wrong address.”

If you have experienced cybercrime and lost money online, contact your bank immediately. You can also report to police via www.cyber.gov.au/acsc/report.

You should also report scams or attempted scams to Scamwatch at www.scamwatch.gov.au