General News

11 September, 2023

Scams targetting bank customers

Bendigo Bank customers are being warned to be wary of scammers targetting account holders via email or phone calls — with some locals receiving calls from a spoofed number impersonating a Bendigo phone number. The scam emails include Bendigo Bank...

Bendigo Bank customers are being warned to be wary of scammers targetting account holders via email or phone calls — with some locals receiving calls from a spoofed number impersonating a Bendigo phone number.

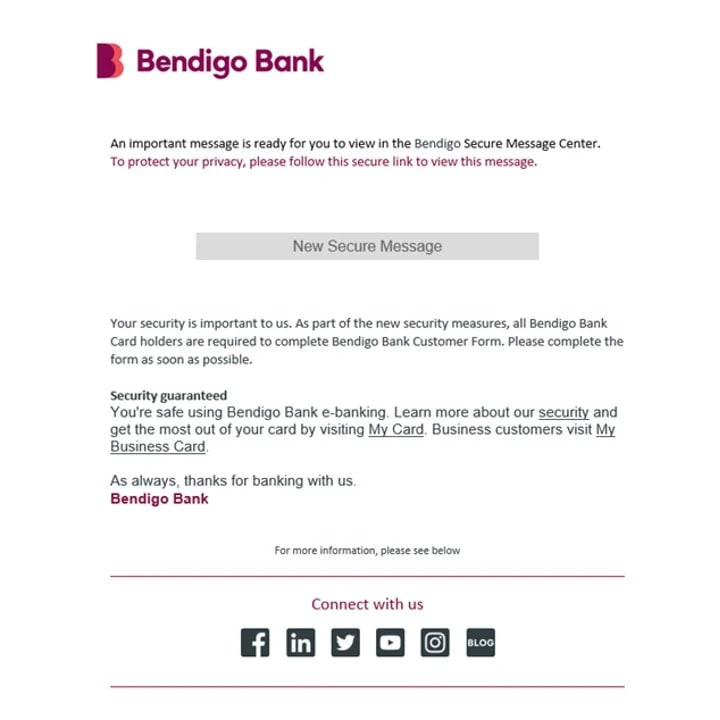

The scam emails include Bendigo Bank images and branding, and ask recipients to access an important message via a secure message centre.

If you click on the link, you will be taken to a phishing website — do not click the link in this email.

An increase in spoofed calls and texts from banks has also been on the rise, according to Scamwatch and the local community bank branch.

Spoofed calls are when scammers use new technology to trick their victims, by making the call appear to come from the bank’s legitimate phone number or by sending a text message that appears in the same conversation thread as genuine bank messages.

“It’s an ongoing challenge for us, we try to play a pretty active role in scam awareness to our customers and our community — we want people to know the signs and red flags,” Community

Bank Avoca, Maryborough and St Arnaud Agency branch manager Joel Condon said.

“These different types of scams are becoming more frequent. They’re becoming more sophisticated and it’s not just affecting people in the older demographic, young people can fall victim to them as well.”

Mr Condon said it’s important for customers to act quickly if they’ve given out personal or banking details to a suspected scammer.

“If customers have received suspicious calls or emails, you can contact your local branch and query it,” he said.

“If you feel you’ve given out some personal information you’re uncomfortable, act very quickly. You can call Bendigo Bank’s 1300 236 344 out of hours.”

Bendigo Bank is reminding customers they will never ask you to login to Internet Banking via a link sent in an SMS or sent in an email.

If you receive an email you’re unsure about, do not click on links. Search for the bank’s phone number independently and call to confirm whether the email is suspicious.

In 2023, more than $328 million has been lost to scams, according to Scamwatch, with over 182,500 scams reported.

Victoria has the country’s second highest reported financial loss to scams at over $75 million, just below NSW’s more than $96 million.

According to Scamwatch, signs of a bank impersonation scam can include:

• A sense of urgency or threat to the message such as “your bank account has been accessed”, “your bank account has been locked” “a payment has been made from your account. If this was not you, please call (phone number)”.

• The message looks different to other messages in the SMS/text thread, such as different wording or phrases used.

• The message may contain a suspicious looking link. Never click on links.

• The SMS/text has a telephone number to call — always find your bank’s phone number inde-pendently.

• The caller will tell you to transfer money to a different account to ‘keep it safe’ or for ‘further investigation’. This is not standard procedures for a bank. It is a scam.

If you have received a suspicious Bendigo Bank email, phone call or text you can forward it to phishing@bendigoadelaide. com.au for investigation.

To find more information about current scams and how to protect yourself, or to report a scam visit Scamwatch at www.scamwatch. gov.au